Global Tail Risks in Focus | 2022

Military conflict in the Taiwan Strait

divides the world economically.

A massive bond sell-off triggers a

liquidity crisis.

A cyberattack takes down the backbone

of the foreign exchange markets.

what if?

The one certainty in life is that there will be uncertainty—and as history shows, the same holds true for investing. Unexpected events fuel the rise and fall of markets and generate windfalls and losses, and can cause domino effects that define the financial landscape for decades to come.

The world runs on risk, and with every investment, we balance risk and return. Traditional portfolio strategies assume that market returns follow a normal distribution—but experience tells us that things aren’t quite so tidy.

ENTER: TAIL RISK.

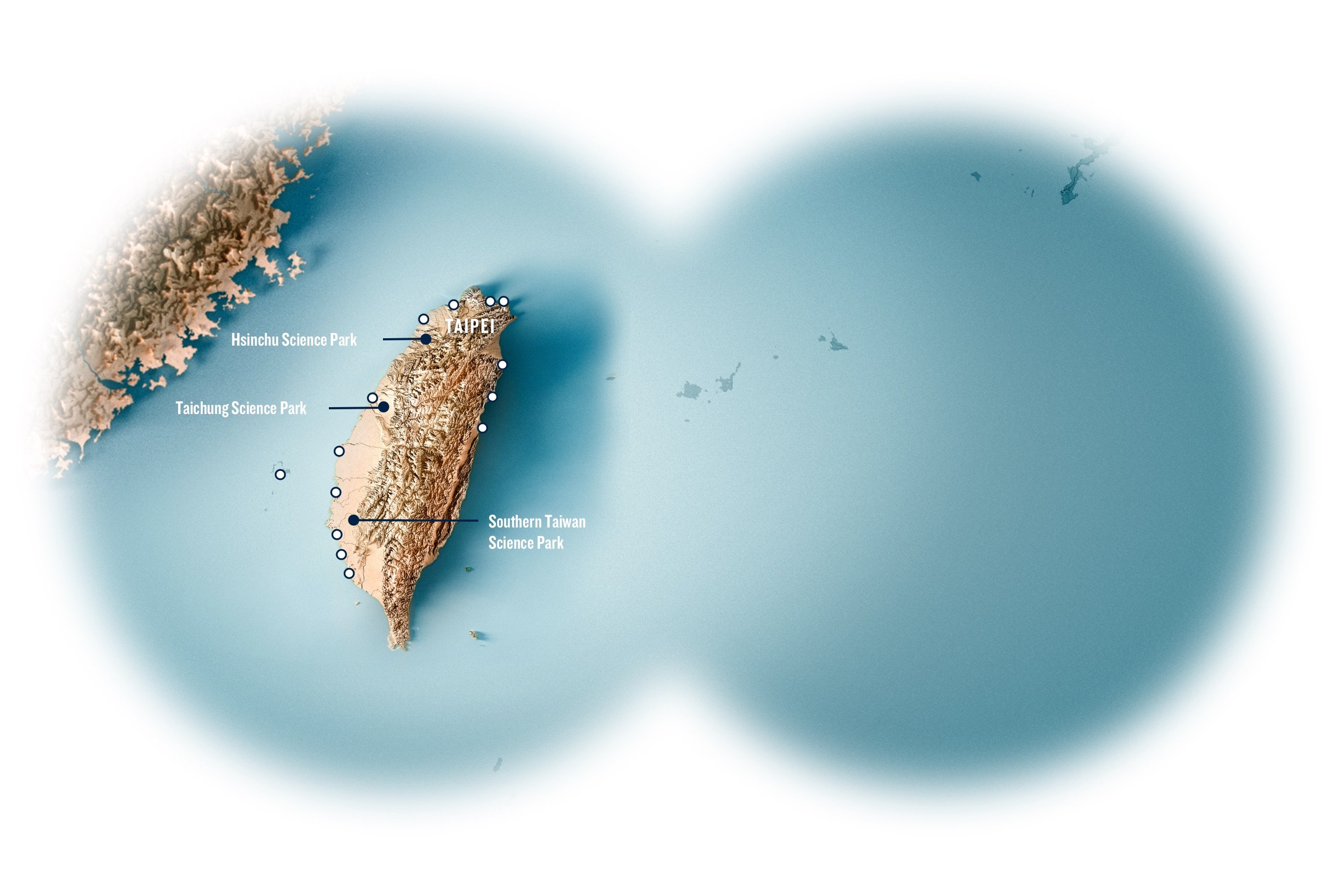

in the Taiwan Strait

The Taiwan Strait, which separates mainland China from Taiwan, is less than 100 miles wide at its narrowest point. If a military conflict erupted, aircraft carriers could cross the strait in less than three hours.

With tensions high between Taiwan and mainland China, investors are perturbed. Military conflict in the South China Sea is the third most powerful tail risk for the PGIM survey’s respondents around the globe.

I call it an economic atomic bomb.

To me, there is no comparable risk.”

Senior Fellow, Bruegel and Senior Fellow, East Asian Institute of the National University of Singapore

Alicia García-Herrero

In a crisis, it’s what you don’t see that usually gets you.”

Professor of the International Financial System, Harvard Kennedy School, and Former SVP and Chief Economist, World Bank

Carmen Reinhart

Taiwan is the world’s leading producer of semiconductors, often called the “new oil.” If conflict arose and led to an interruption in trade from Taiwan’s ports, it would cripple the manufacturing of everything from cars to computers to combat drones.

TRADE SHIP TRAFFIC

Military conflict in the Taiwan Strait would threaten one of the world’s most highly-trafficked trade routes.

Nearly half of the global container fleet and 88% of the largest container ships transited the strait this year.

Source: Bloomberg Terminal

If conflict led to an interruption in trade from Taiwan, it could halt exports from the world’s leading semiconductor manufacturer.

Potential Trade Disruption

Source: Bloomberg Terminal, Contact Taiwan

92%

of the most advanced semiconductors are produced in Taiwan.

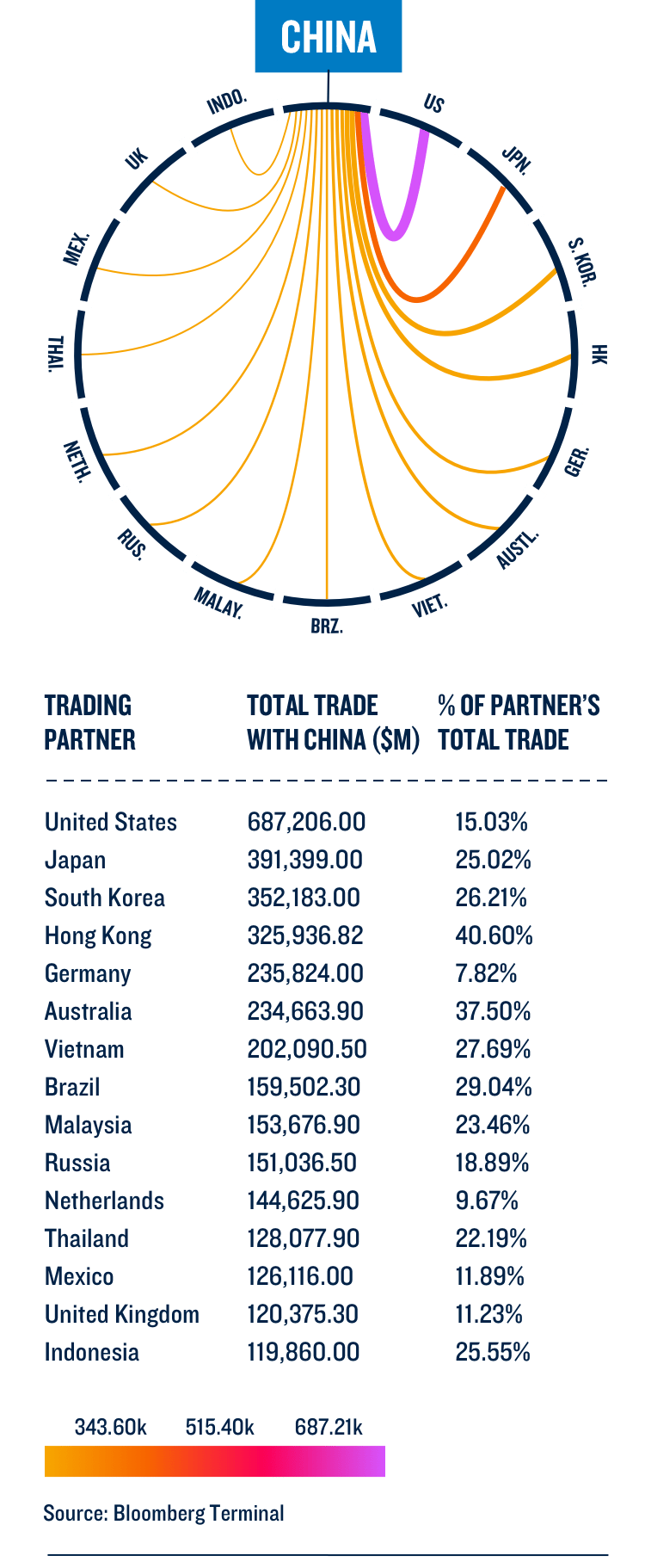

Alicia García-Herrero, Senior Fellow at the Bruegel think tank and Senior Fellow at the East Asian Institute of the National University of Singapore, says that the conflict would be extremely divisive; the world would split in two, taking strong stands on their chosen sides.

Russia is likely to back mainland China, as it has been vocal in its support of Beijing’s “One China” policy. According to García-Herrero, the US, Japan and Australia would likely be the most active in opposition to mainland China’s involvement.

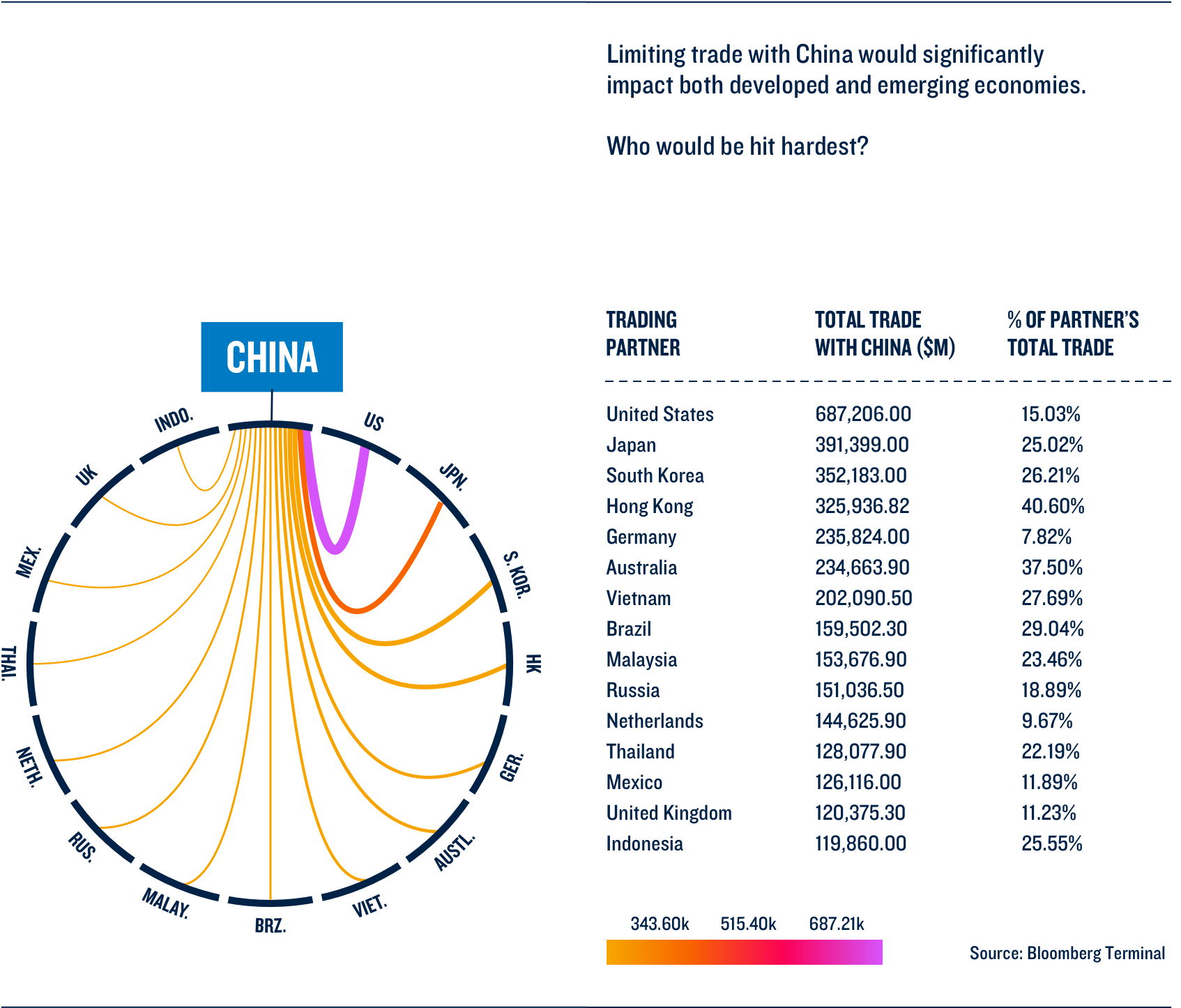

HOW MIGHT

CHINA’S TRADE RELATIONSHIPS

IMPACT THE WORLD’S RESPONSE?

“Imagine that you say that nobody in the G7 can buy into any Chinese company that issues foreign debt. This is a longer-term shock,” García-Herrero explains. “It pushes toward financial decoupling very rapidly, and it creates humongous inflationary pressures and delays in production of any electric good in the world.”

Many investors are already leaving the equity market in Taiwan amid tensions. García-Herrero advises that global investors seeking to mitigate risk should consider steering clear of the renminbi and Taiwan dollar, and look instead to mirror currencies such as the Indian rupee.

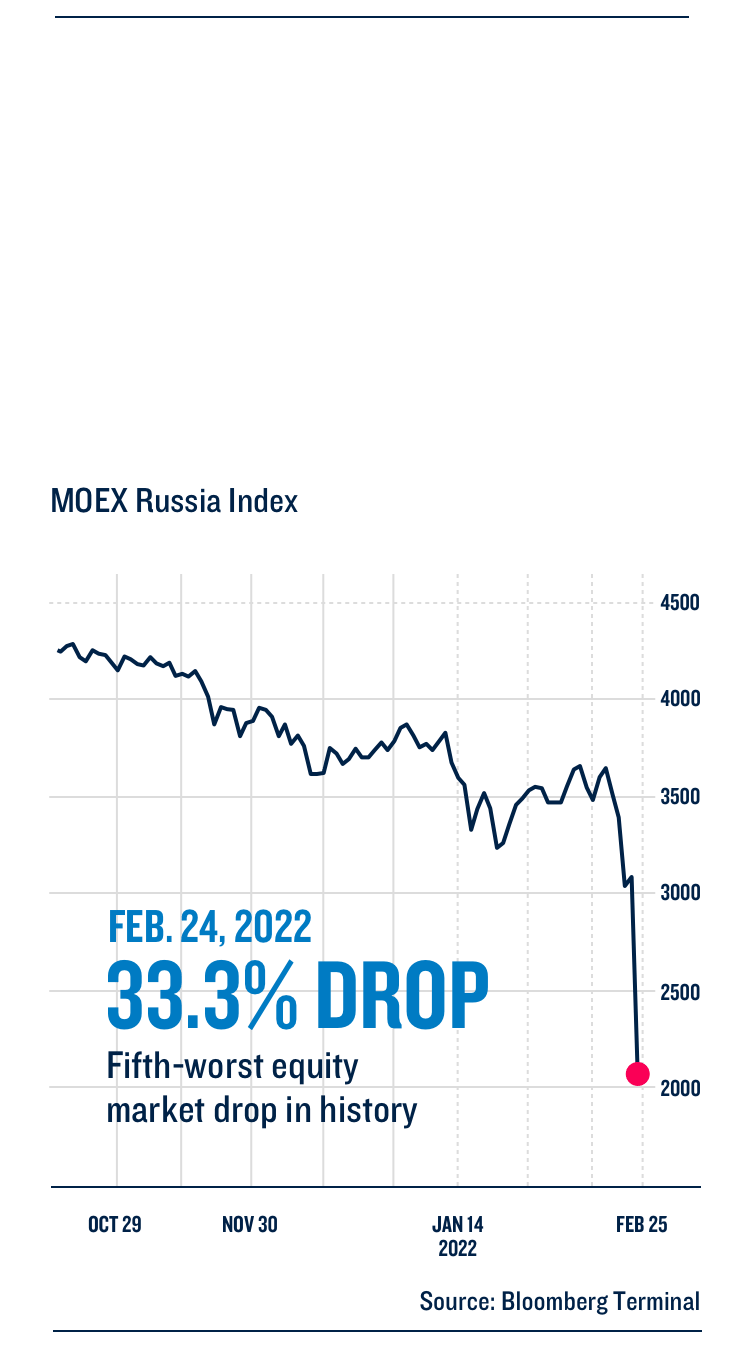

Envisioning the impacts of this significant geopolitical risk helps investors to interrogate their own assumptions and consider all their options. After all, the military conflict in Ukraine, once deemed highly unlikely, has proved to be a potent tail event that investors didn’t see coming even in the days before it escalated—and their portfolios paid the price.

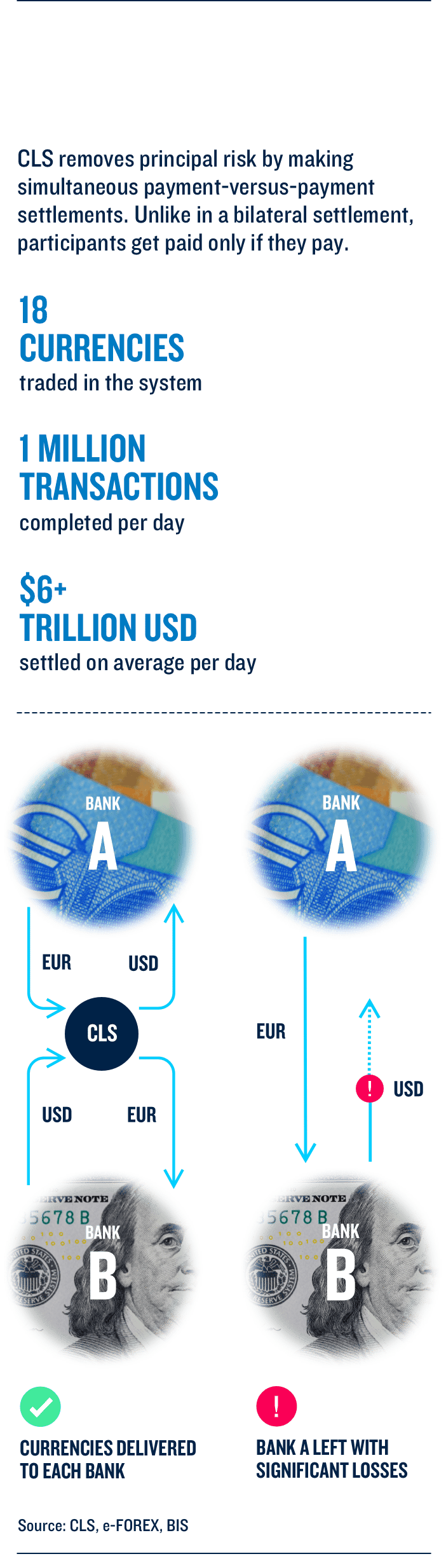

TAKES DOWN A FINANCIAL PLATFORM

A digital payment instruction flows through the virtual ether—one of the 1 million payments that will be processed that day by Continuous Linked Settlement (or CLS), the world’s leading foreign-exchange settlement bank. It’s moving quickly, transitioning $750 million from New York to an equally sizable euro payout in Frankfurt.

But before the payment is settled, everything stops. The payment is suspended, in limbo—leaving Frankfurt wanting for its cash as it prepares its next transaction.

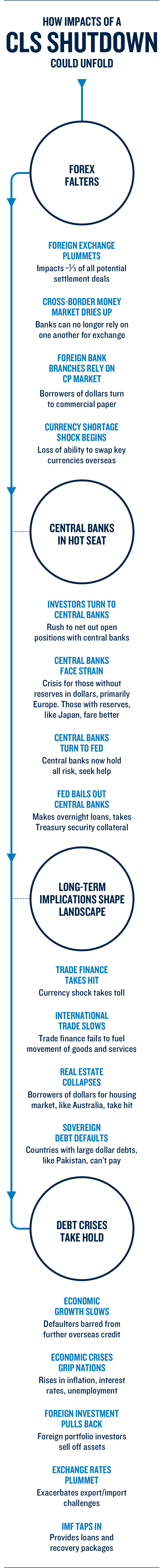

It’s a cyberattack on CLS, and it will throw the FOREX market into chaos. This interference limits the ability to transact in key currencies like the dollar, and risks massive financial deglobalization.

HOW DOES

CLS WORK?

If a nation whose currency wasn’t traded through CLS were to take the platform down, they’d endure minimal fallout while disproportionately damaging the economies of the US, Europe and their allies.

Financial institutions are prime targets of nation-states and ransomware groups alike because of their importance and relative vulnerability, explains David Kennedy, Founder and Chief Hacking Officer of cybersecurity firms TrustedSec and Binary Defense Systems and a former United States Marine Corps intelligence specialist.

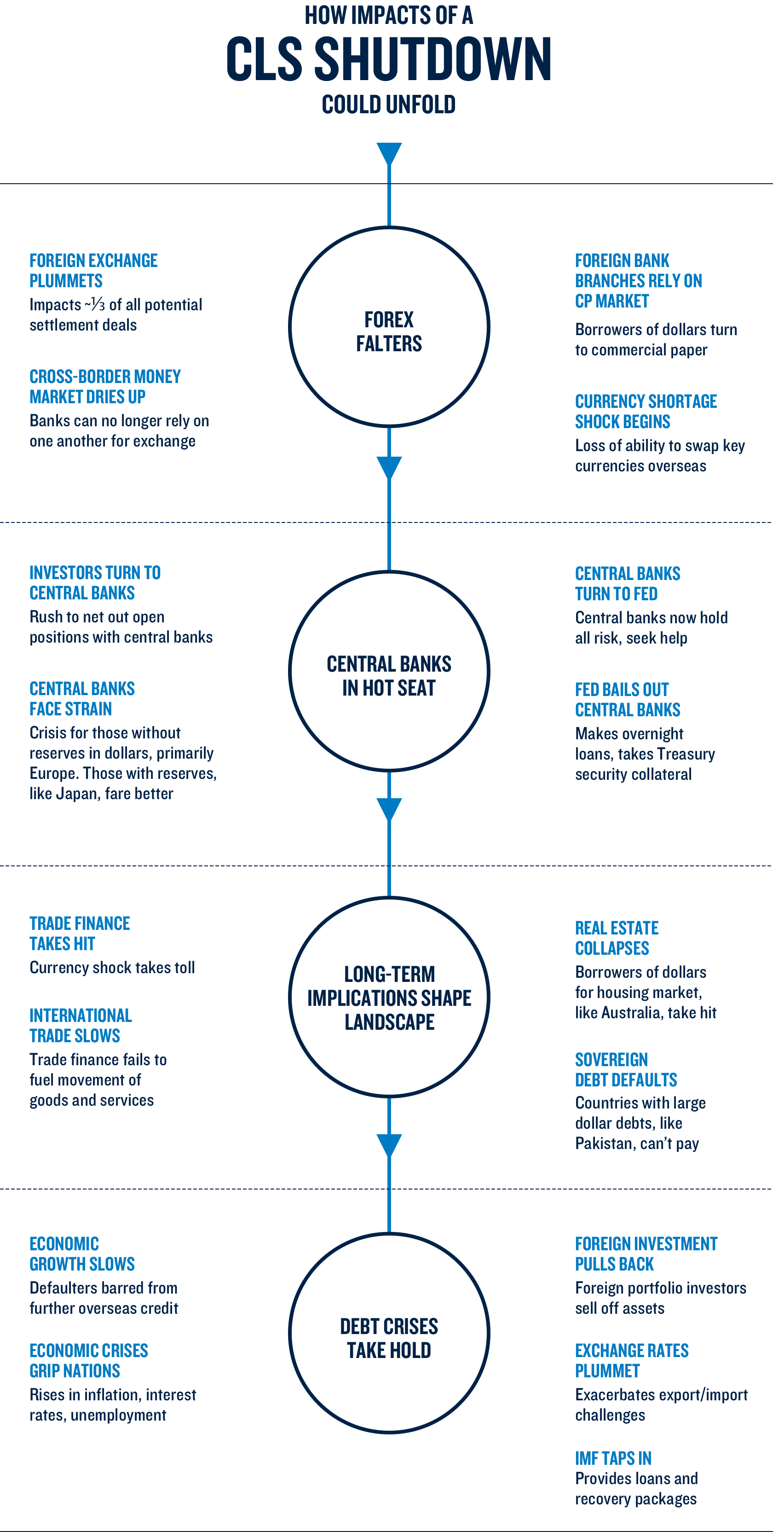

CLS SHUTDOWN

HOW IMPACTS OF A

COULD UNFOLD

A cyberattack on a major financial platform is a tail event on the minds of institutional investors around the globe, coming in as the second leading tail risk in PGIM’s recent survey. A take-down of CLS exemplifies the risk, because it would not only impede crucial transactions, but also likely lead to market panic.

crashes markets

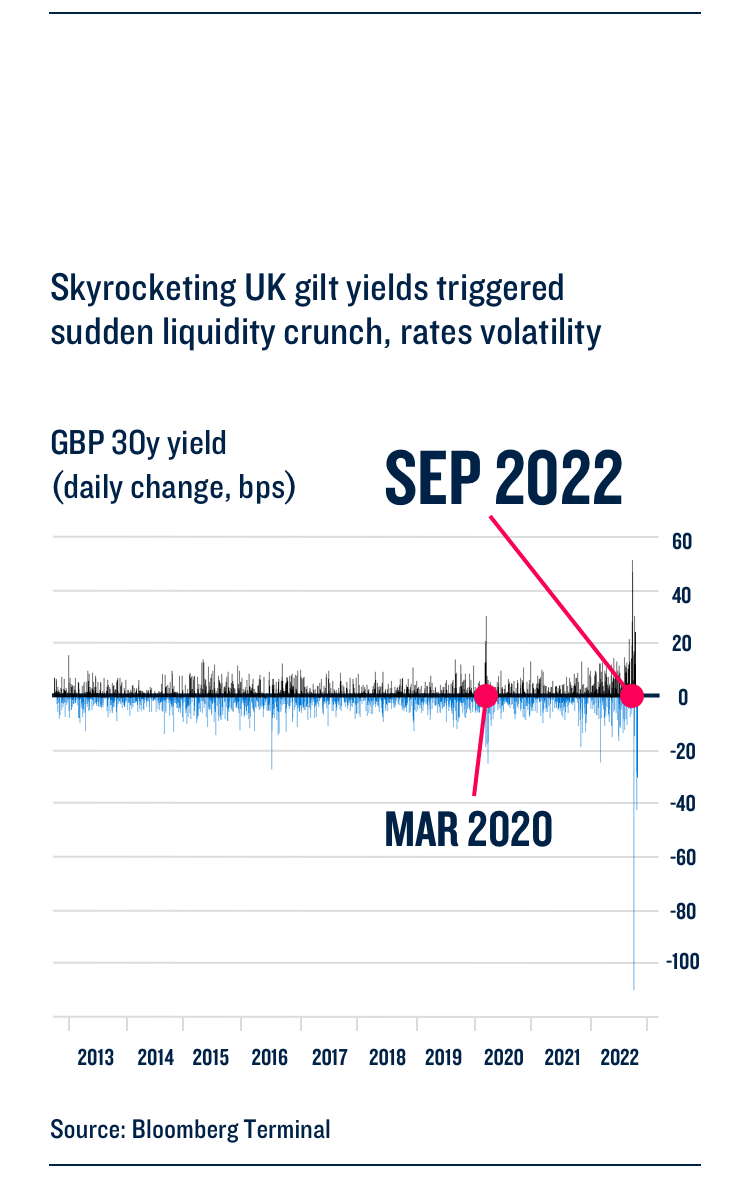

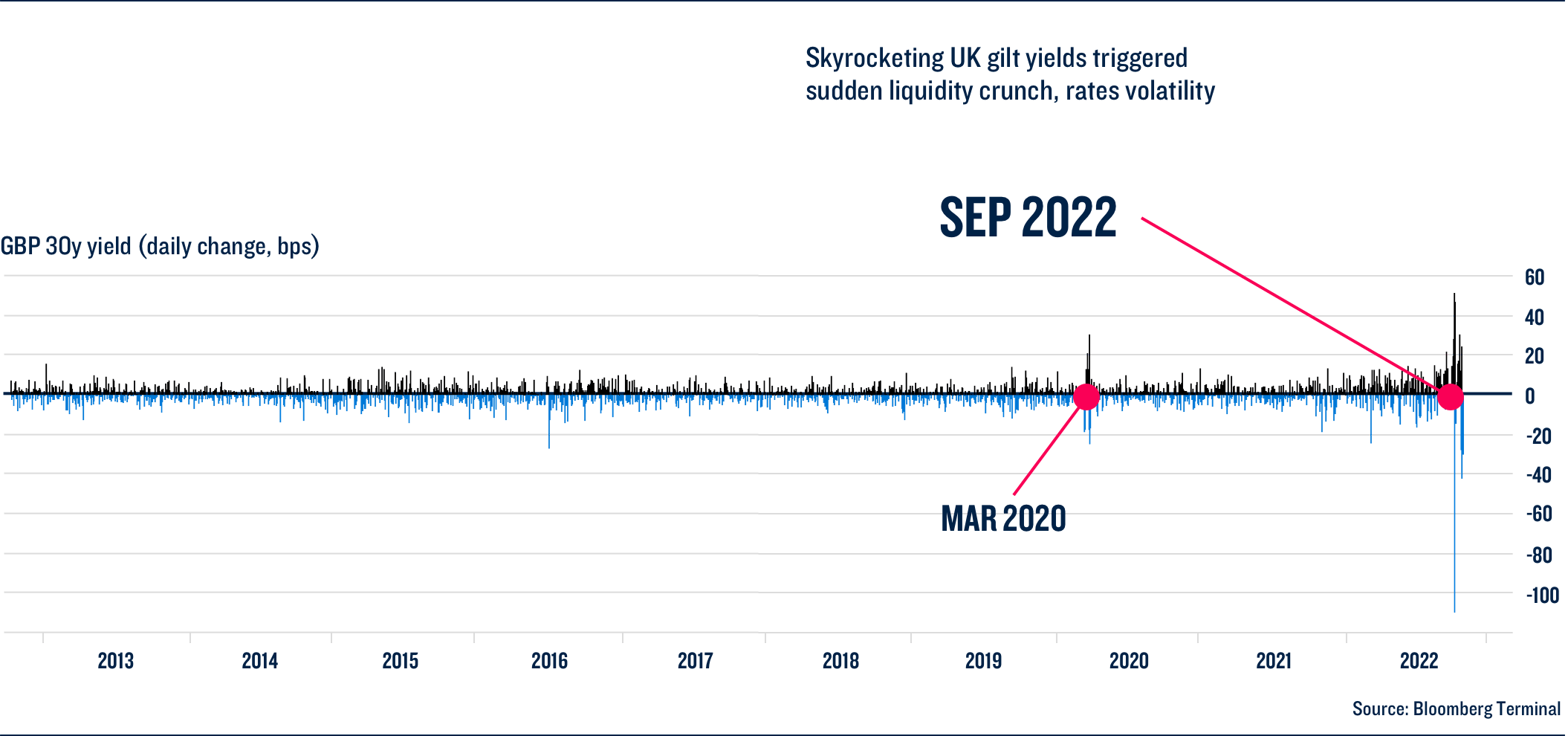

It’s a dark day in capital markets: Bond yields surge suddenly and violently, sending investment managers scrambling to cough up cash in mere hours. It’s high-stakes, to say the least. These particular investment managers happen to be tasked with safeguarding an entire nation’s pension funds, ensuring that generations of people can retire in peace.

Desperation sets in. To meet margin calls, managers offload their next most liquid asset: gilts—bonds issued by the UK government. But the simultaneous sell-off is so intense that it only pushes yields higher, demanding even more cash. It’s a vicious cycle that can only be broken—at least temporarily—by the Bank of England stepping in to buy up the discarded gilts, rocking prices again before they find a relative equilibrium.

This is the nightmare that struck the UK in September 2022, and it shows how liquidity can vanish in a flash.

The PGIM tail risk survey found that of all scenarios, a liquidity crunch in capital markets would have the most impact on institutional investors.

While liquidity crises may come in different shapes and sizes—from a run on cash during global shutdowns in 2020 to the domino effect of defaults during the 2007–2008 Global Financial Crisis—envisioning how one could unfold in the future can help protect against fallout, and even provide boons for savvy investors.

In another tail risk scenario, central bank tightening could trigger a historic liquidity crisis that leaves markets in turmoil. As volatility in asset markets increases, investors become more risk-averse, and as the investment environment shifts into a risk-off theme, liquidity decreases. The US Federal Reserve decides not to intervene due to prior interventions, or, in an echo of the Global Financial Crisis, in response to moral hazard. The US crisis becomes a global one.

Today, the Federal Reserve is tightening at a historically fast pace, but quickened interest rate hikes and balance sheet sell-offs may still be necessary to combat 40-year highs in inflation.

“The reason we had a secular decline in interest rates and an ever-greater comfort level with higher and higher price/earnings ratios was that many thought that inflation was dead,” reflects Carmen Reinhart, Professor of the International Financial System at Harvard Kennedy School and former SVP and Chief Economist of the World Bank. “I never believe anything is dead. This is like the Loch Ness monster: It goes underwater, but when you least expect it, Nessie raises its head.”

And now, the tightening required to reign in the monster we didn’t see coming could create another one entirely.

“When you have significant corrections in any asset prices, whether it’s real estate, equity, bonds or a combination of those, you are going to get a lot of bankruptcies you didn’t know you had,” Reinhart warns. Those who are over-leveraged will be liquidating assets to rebuild or repay, which can fuel the asset price decline. High-yield corporate debt is likely first in line to be hit.

She advises that the biggest impediment to identifying these vulnerabilities is preoccupation with the problems we’ve just encountered. To assess any risk, Reinhart emphasizes that we must consider the initial conditions at play and remember that crises rarely travel alone.

“Preparing for the last crisis is unimaginative,” she says. “Thinking about the next shoe to drop is always good discipline.”

THE FUTURE in

Investors can’t predict the future, but they can ask:

The concept of tail risk recognizes that the distribution of returns is skewed by “fat tails.” These tails reflect the probability that an asset’s return will fall beyond three standard deviations of the mean—an unexpected outcome that can upend an investment portfolio.

A recent survey by PGIM of 400 institutional investors around the globe (with $12 trillion AUM) has identified the top tail risks that could have the greatest impact on investors’ portfolios if they come to pass—and for which they are least prepared.

We spoke to the world’s most original financial thinkers to ask: What if?

TAIL RISKS:

MILITARY CONFLICT

LIQUIDITY CRUNCH

CYBERATTACK

MILITARY CONFLICT

Europe might be hesitant to limit trade because its economy is extensively interlinked with China.

Regardless, capital controls are all but certain.

As some of the world’s most systemically important financial institutions are in China, limiting trade would create a huge shock for the global financial system.

RUSSIAN STOCK

MARKET PLUNGE

Behavior in the Russian stock market suggests investors did not believe that military conflict was coming. Stocks plummeted on the day of the attack on Ukraine.

MILITARY CONFLICT

LIQUIDITY CRUNCH

CYBERATTACK

Liquidity Crunch

TAIL RISKS:

SHARP SWINGS

IN UK Gilt YIELDS

Swift, V-shaped exits from liquidity shocks are rare. The long period of time it took the US—and the much longer time it took Europe—to recover from the Global Financial Crisis is closer to the norm than the exception.

MILITARY CONFLICT

LIQUIDITY CRUNCH

CYBERATTACK

CyberAttack

TAIL RISKS:

CLS would be particularly targetable because it excludes certain currencies like the renminbi and the ruble.

Suddenly you start to create a lack of confidence in other banks in that ecosystem. The ripple effect not only on the stock market, but the global economy, would be frightening to comprehend.”

CEO, Fortalice Solutions and Former Federal CIO of the United States

Theresa Payton

The systems that are used in the back-end in financial institutions are extremely vulnerable—they’re ancient and archaic. Most banks are still leveraging mainframes that have been out of support for 20 years.”

Founder & Chief Hacking Officer, TrustedSec and Binary Defense Systems

David Kennedy

The extent of the damage of an attack on CLS would depend on its origin, duration and stealthiness—hackers can access and manipulate a system for months or years before their presence becomes apparent, making recovery that much more difficult.

Theresa Payton, CEO of the cybersecurity firm Fortalice Solutions and former White House Chief Information Officer, advises that to protect against risk, it’s crucial to envision the incidents such as this that would lead to system-wide consequences.

For investors, that can mean adopting an outcome-based mindset. Envisioning an extreme negative outcome, such as an implosion of their portfolio, and detailing the sequence of events that could lead it to happening reveals vulnerabilities and illuminates opportunities to get ahead of them.

That preparatory mentality is critical when it comes to considering this tail risk in particular, as a successful cyberattack on CLS—or any other major financial system, such as SWIFT or the NYSE—could cause injury to the global economy and even more serious repercussions.

The UK, US, Germany, Israel and Australia are among the countries that have indicated that they would consider extreme cyberattacks to be akin to “kinetic” attacks—and could therefore trigger a military response—but there is a lack of consensus in the international community on the point. This murkiness means anything could happen, including all-out war—a potent illustration of the far-reaching impact of tail risks.

“There is no international law around cyber warfare,” explains Kennedy. “There are no rules of engagement, and we don’t know what that line is because it’s never been drawn before.”

Sushil Wadhwani, Chief Investment Officer at PGIM Wadhwani, believes that it’s impossible to predict the next tail events that will determine the future of our markets; we can only prepare for the eventuality that the unexpected will occur. So, to plan well, it’s key to plan for anything.

In a world of unknown unknowns, what happens will be different than anything you planned for.”

Chief Investment Officer, PGIM

Sushil Wadhwani

The barrier to adopting a robust risk management strategy usually arises from a CIO’s fear that they’ll underperform in good times against their competition.

The PGIM survey demonstrates that in this time of volatility, institutional investors around the globe want protection for their portfolios, but too few are taking action.

He explains concerns of underperformance are unnecessary, and that a well-balanced risk strategy leans into a mix of investments that perform best in opposite environments. On average, they make small gains when the market goes up and large gains when markets are challenged.

It’s a strategy proving more powerful now than ever, in light of the global pandemic and the major conflict in Europe—two “once-in-a-generation” events that have struck within two years.

Rare as they may be, tail events are shaping our economic landscape. And with investors around the globe united in exposure to these risks, there’s no time like the present to adopt a more imaginative mindset.

Limiting trade with China would significantly impact both developed and emerging economies.

Who would be hit hardest?

MILITARY CONFLICT

LIQUIDITY CRUNCH

CYBERATTACK

Liquidity crunch

TAIL RISKS:

MILITARY CONFLICT

LIQUIDITY CRUNCH

CYBERATTACK

CYBERATTACK

TAIL RISKS: